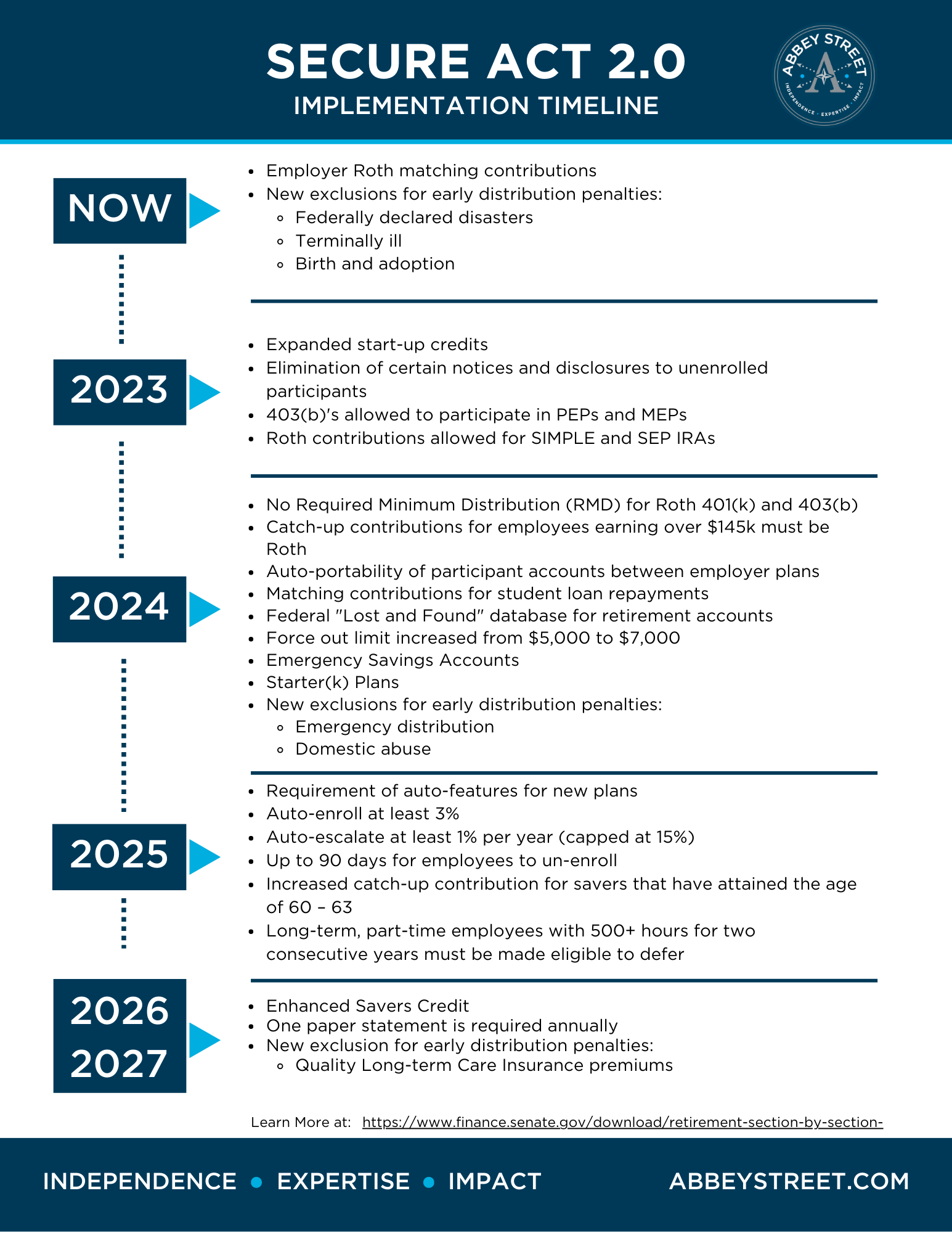

Following the passage of SECURE Act 2.0, at the end of 2022, plan sponsors are beginning to work closely with their recordkeeper, payroll provider, and advisor to understand the implementation process for various required and optional provisions. One of these provisions affects catch-up contributions for some participants.

Section 603 of the SECURE Act 2.0 requires timely attention: catch-up contributions for participants earning over $145,000 must be contributed as Roth. This provision is effective January 1, 2024, and is based on the prior year’s income.

Plans without Roth will not be able to allow their participants over age 50 to make catch-up contributions.

Abbey Street has been busy assisting clients with this Roth component and ensuring the $145,000 threshold is calculated and communicated accurately before the effective date.

Please reach out to an Abbey Street team member today if you would like help understanding or implementing this provision.

To learn more about the SECURE Act 2.0, the 92 provisions, and the impact they may have on your business’s retirement plan, we invite you to connect with our team of experts.

SECURE Act 2.0 Legislation: https://www.finance.senate.gov/imo/media/doc/Secure%202.0_Section%20by%20Section%20Summary%2012-19-22%20FINAL.pdf

Abbey Street SECURE Act 2.0 Implementation Timeline PDF: https://abbeystreet.com/wp-content/uploads/2023/03/Abbey-Street-Secure-Act-2.0-Implementation-Timeline.pdf

Start a conversation to learn more about who we are and what we do. Our team is ready to make an impact.

Contact Us