The SECURE 2.0 Act was passed on December 23rd, 2022 and aims to enhance the original SECURE Act of 2019 by adding new provisions to qualified retirement plans.

In December of 2022, Congress passed the Consolidated Appropriations Act, 2023, which contains a large section covering retirement in the U.S. referred to as SECURE 2.0. The Act builds upon or enhances the Setting Every Community Up for Retirement Enhancement Act of 2019 (the SECURE Act).

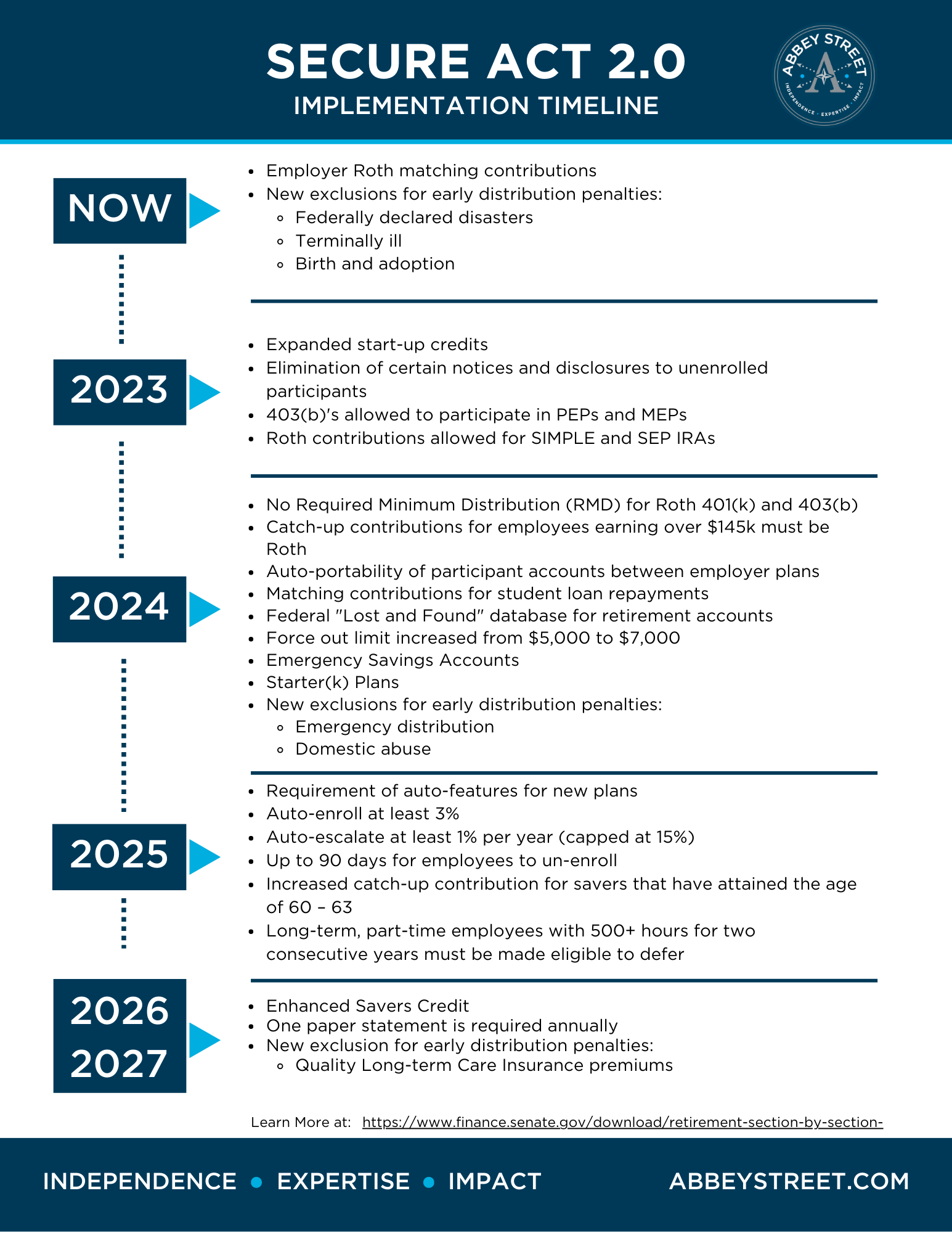

The SECURE Act 2.0 includes 92 new provisions with the ultimate goal of increasing savings, offering more flexibility to those contributing to a retirement plan, and lowering the employer cost to start a new retirement plan for their business. Several of these provisions went into effect at the beginning of this year (January 1st, 2023) while the rest will be implemented between now and 2027.

Below is an implementation calendar, detailing when each major provision will go into effect. Download a PDF version of this calendar here.

To learn more about the SECURE Act 2.0, the 92 provisions, and the impact they may have on your business’s retirement plan, we invite you to connect with our team of experts.

SECURE Act 2.0 Legislation: https://www.finance.senate.gov/imo/media/doc/Secure%202.0_Section%20by%20Section%20Summary%2012-19-22%20FINAL.pdf

Abbey Street SECURE Act 2.0 Implementation Timeline PDF: https://abbeystreet.com/wp-content/uploads/2023/03/Abbey-Street-Secure-Act-2.0-Implementation-Timeline.pdf

Start a conversation to learn more about who we are and what we do. Our team is ready to make an impact.

Contact Us