Featured Insights

Retirement Plan Services

Roth Catch-up Contributions in Retirement Plans

Retirement Plan Services

After a 2-year postponement, catch-up contributions will be required to be in Roth dollars for some participants.

Learn more

401(k) Plan Audit: The Basics

Retirement Plan Services

If your organization offers a 401(k) plan, understanding when & why an audit is required is essential for maintaining compliance & avoiding penalties.

Learn more

STREET SMARTS | Quarterly Market Review

Retirement Plan Services

Director of Investments, Brandt Colville, provides a high-level explanation of a resource the Abbey Street team creates & presents each quarter to help facilitate discussions during clients meetings.

Learn more

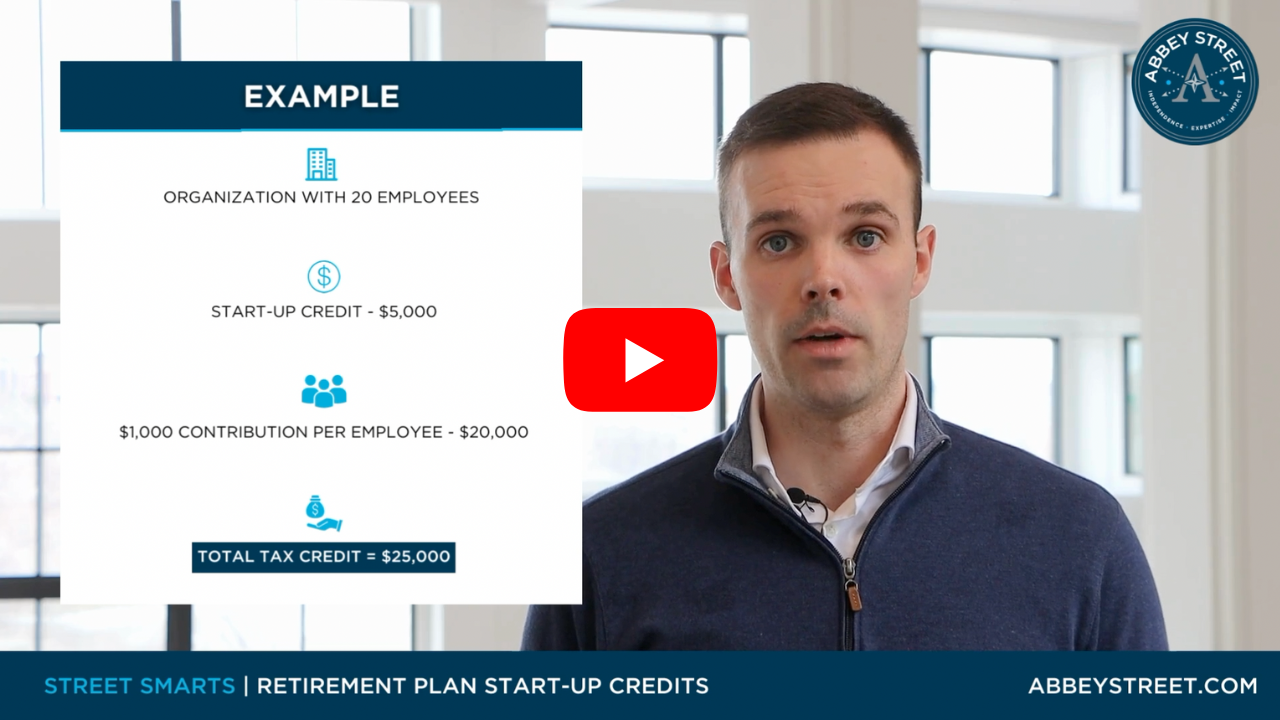

STREET SMARTS | Retirement Plan Start-Up Credits

Retirement Plan Services

Business Owners - Now you can offer a new retirement plan to your employees and offset the costs with tax credits! Learn more about how this process works from Blake Faust.

Learn more

STREET SMARTS | Plan Success

Retirement Plan Services

Corporate retirement plans and their components vary from organization to organization. Which of these components are important to measure?

Learn more

STREET SMARTS | Profit Sharing

Retirement Plan Services

Business Owners - Are you getting the most out of your retirement plan? Director of Retirement, Blake Faust, discusses advanced planning profit sharing design.

Learn more

STREET SMARTS | Spot Bitcoin ETF

Retirement Plan Services

On January 10th, 2024 the SEC approved eleven Spot Bitcoin ETF products. Brandt Colville, Director of Investments, discusses this topic with Abbey Street's President, Dan Mulheran.

Learn more

2024 Plan Contribution Limits Announced by IRS

Retirement Plan Services

The IRS has released the 2024 retirement plan contribution limits. See them here!

Learn more

Minnesota Passes State-run IRA Program for Small Businesses

Retirement Plan Services

Recently passed legislation will require MN businesses with five (5) or more employees to use a State-run IRA program if they do not currently offer retirement benefits.

Learn more

Attention Needed: Roth Catch-up Contributions with SECURE Act 2.0

Retirement Plan Services

The SECURE Act 2.0 includes a new provision that goes into effect January 1st, 2024 and affects catch-up contributions for some participants.

Learn more