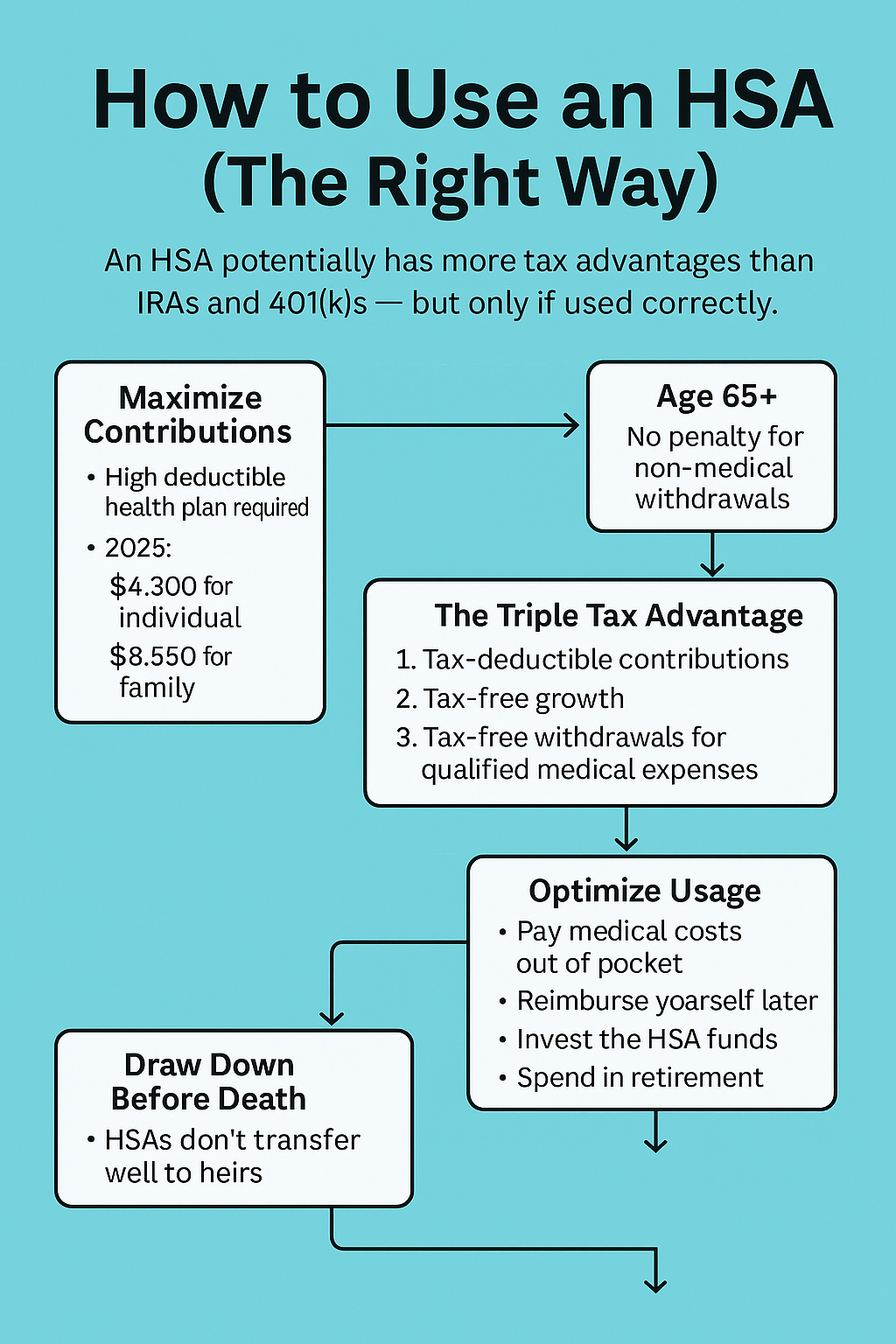

A Health Savings Account (HSA) is arguably the most tax-efficient financial tool available — even more powerful than IRAs or 401(k)s. But most people don’t use it to its full potential.

Used correctly, an HSA can serve not just as a way to pay for medical expenses, but as a long-term wealth-building and retirement planning strategy.

Here’s how to make the most of it.

To contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). This is the baseline requirement that unlocks access to all the HSA’s benefits.

2025 HSA Contribution Limits:

These contributions can be made with pre-tax dollars (via payroll) or deducted from your taxable income at year-end.

The HSA stands apart from other tax-advantaged accounts because of its triple tax benefit:

No other account offers all three.

Most people treat their HSA like a checking account for health expenses. But if you want to build wealth, you need to treat it like an investment account.

Here’s how:

Pay for medical expenses out of pocket

Use a credit card or other funds to cover costs upfront. Save the receipts and documentation.

Don’t reimburse yourself immediately

There’s no time limit for reimbursing qualified expenses. This means you can allow your HSA funds to grow for decades before taking a tax-free distribution for something you paid for years ago.

Invest the balance

If you don’t need the funds short-term, invest your HSA. Many providers offer mutual funds or ETFs once you reach a minimum balance (often $1,000 or $2,000).

This strategy allows your HSA to grow significantly over time — with all the growth tax-free if eventually used for eligible medical costs.

At age 65, your HSA becomes more flexible:

In essence, your HSA becomes another retirement account — one with the added advantage of tax-free distributions for healthcare, which is likely to be one of your biggest expenses in retirement.

While HSAs are excellent during your lifetime, they are not ideal to leave behind.

If your spouse inherits the account, it remains an HSA. But if someone else inherits it, the entire account becomes taxable to them in the year of your death — unlike Roth IRAs, which allow for tax-deferred growth over time.

This makes it wise to spend down your HSA in retirement, especially if you anticipate large healthcare costs or if you’re in a position to reimburse yourself for decades of past qualified expenses.

The HSA is often overlooked or underutilized. But when used correctly, it becomes a highly effective tax and retirement planning tool.

Summary of Best Practices:

By thinking of your HSA as a long-term savings account rather than a short-term spending account, you can unlock one of the most efficient vehicles available in personal finance.

Healthcare.gov – https://www.healthcare.gov/high-deductible-health-plan/hdhp-hsa-work-together/

Start a conversation to learn more about who we are and what we do. Our team is ready to make an impact.

Contact Us