In meeting with clients, we’ve learned that two of the most misunderstood aspects of their balance sheets are their Stock Options and Restricted Stock Units (RSUs). Over the next couple of weeks we’ll detail the basics of each in hopes of clearing up some of the major misunderstandings.

While RSUs do have some complexities, it is important to manage them effectively to maximize your wealth. Let’s take a brief look at what RSUs are, how they are taxed and what you need to know to make the most of their benefit.

RSU’s are a way your company/employer can grant you shares of the company. Often these shares will be tied to performance of the company or be based on a term of employment. Once these terms are met the shares will “vest”. At that time the share owner will gain voting and dividend rights to the shares (there are some RSUs that do pay dividends to unvested shares and in that case the dividend would be reported as W2 wages in the year they are paid).

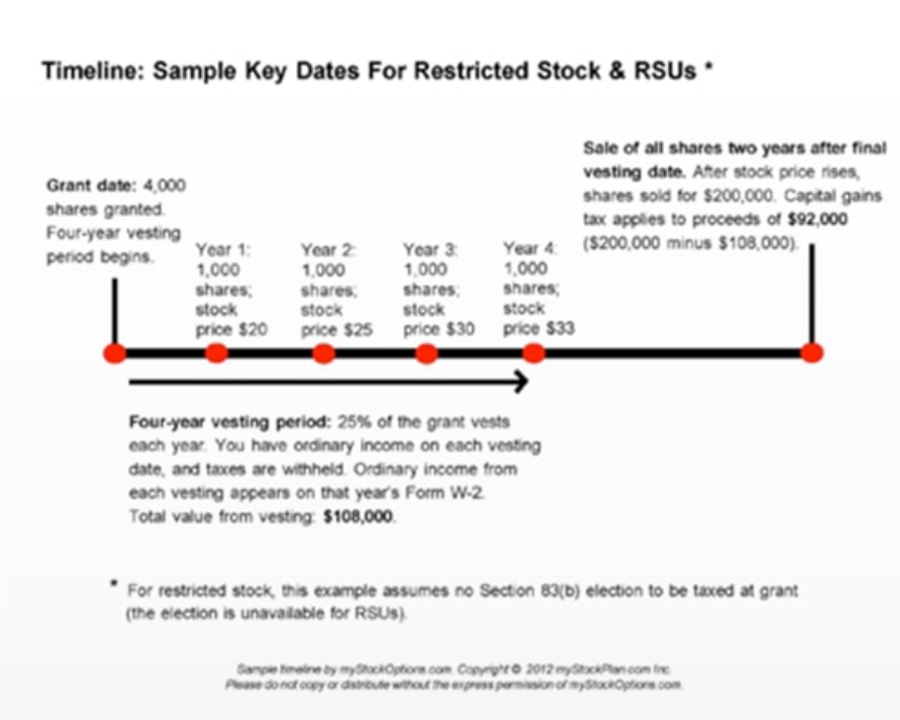

Two of the more common vesting schedules would be a “cliff” or “graded” vesting schedule. RSU’s that are based on a “cliff” vesting schedule will become 100% vested once the performance goal or period of service requirement is met. With a “graded” vesting schedule a percentage of shares will vest periodically over a scheduled timeframe.

Example: You are granted 10,000 shares of stock on a vesting schedule over 5 years. At the anniversary of your grant date (and the same date for following 4 years) 2,000 shares vest. Once these shares have vested you now can sell the shares if you would like.

With RSUs, you are taxed when you receive the shares. Your taxable income is the market value of the shares at vesting.

Example: Your company grants you 10,000 RSUs when the market price of its stock is $40. By the time the grant vests, the stock price has fallen to $30. The grant is then worth $300,000 to you before taxes.

As stated above, your taxable income is the market value of the shares at vesting. You have compensation income subject to federal and employment tax (Social Security and Medicare) and any state and local tax. That income is subject to mandatory supplemental wage withholding.

Some companies may offer a variety of ways to pay taxes at vesting, or it may use a single mandatory method. The most common practice is taking the amount from the newly delivered shares by surrendering stock back to the company. This holds or “tenders” shares to cover the taxes under a net-settlement process, and company cash is used for the payroll tax deposit.

When you later sell the shares, you will only pay capital gains tax on any appreciation over the market price of the shares on the vesting date.

The following hypothetical example outlines the entire life cycle of an RSU grant.

Your company grants you 20,000 RSUs that vest at a rate of 25% a year. The market price at grant is $18.

One year after the grant, 25% of the shares vest and the stock price is $20 (5,000 x $20 = $100,000 of ordinary income). The following year another 25% of your share’s vest when the stock price is $25 (5,000 x $25 = $125,000). Three years after the initial grant another 25% vest when the stock price is at $30 (5,000 x $30 = $150,000 of ordinary income). Year four your final 25% of shares vest at a stock price of $35 (5,000 x $35 = $175,000 of ordinary income). The total value of all your RSU after vesting is $550,000, and each increment is taxable on its vesting date as compensation income when the shares are delivered.

Let’s assume you pay the tax due each year out of pocket and don’t surrender shares back to the company to pay taxes. At a later date you sell the stock when the price is at $40 ($800,000 for the 20,000 shares). Your capital gain is $250,000 ($800,000 minus $550,000), which is reported on your tax return on Form 8949 and Schedule D. If you hold the shares for more than one year after share delivery, the sales proceeds will be taxed at the long-term capital gains rate, which is a considerable lower rate than short term capital gains.

Although RSU’s are more complex then salary compensation, they are a great way to participate in the growth and success of the company. When making decisions around your RSU’s, it is important to consult with your tax professional.

Charles Schwab Public Resources & Article: https://www.schwab.com/public/eac/resources/articles/rsu_facts.html

Start a conversation to learn more about who we are and what we do. Our team is ready to make an impact.

Contact Us