As clients approach retirement, one of the most common questions we hear is:

“Will my Social Security be taxed?”

The answer depends on the type & amount of income you receive alongside your benefits. Whether you’re still earning, collecting rent, or realizing capital gains, the way your income interacts with Social Security can have a significant impact on your overall tax picture.

Below, we break down how Social Security taxation really works — & how to plan around it.

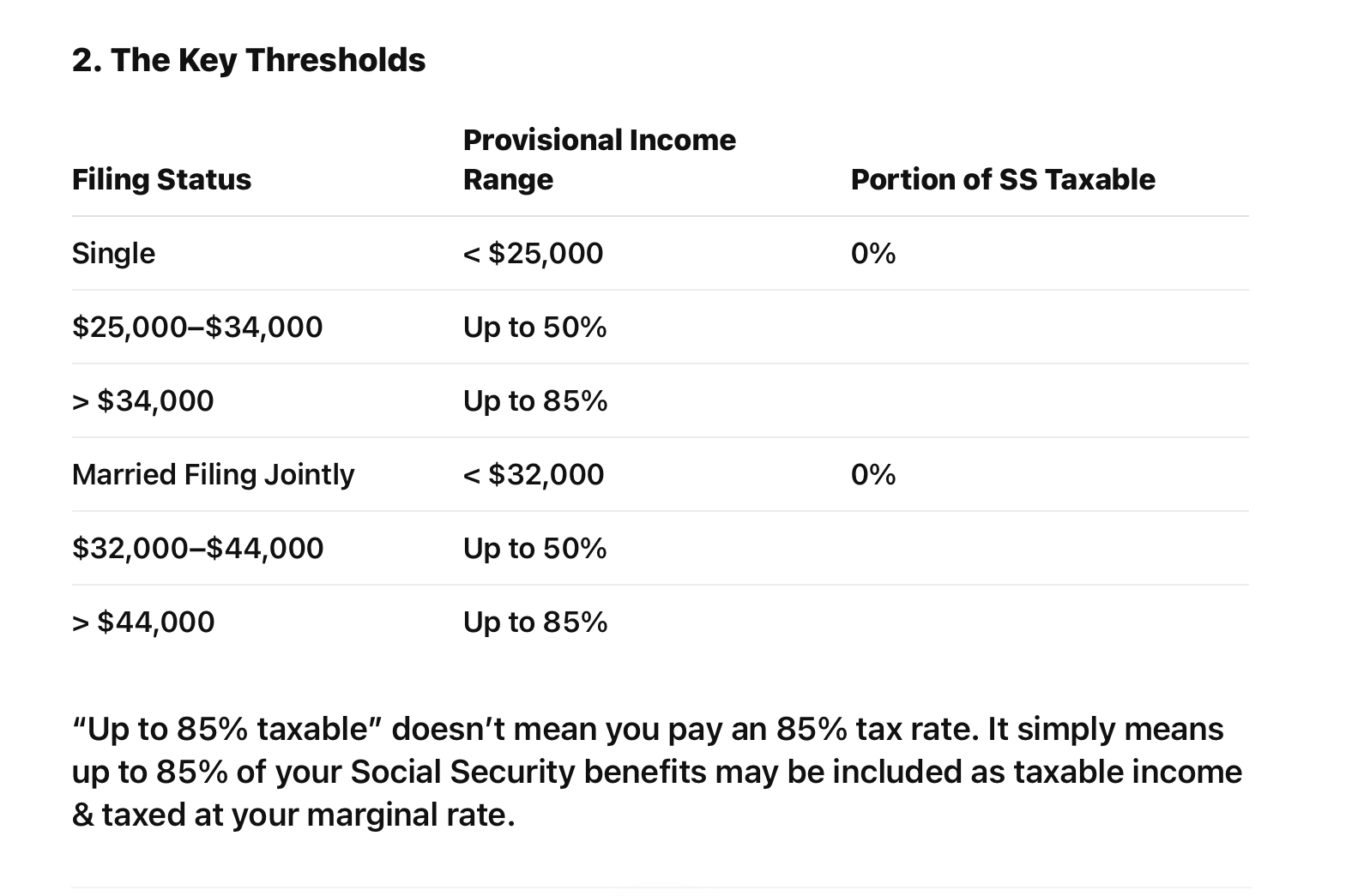

The IRS doesn’t simply look at your Social Security benefits in isolation. Instead, it calculates something called provisional income, which determines how much of your benefit becomes taxable.

Provisional income = Adjusted Gross Income (AGI)

This formula means that earned income, passive income, capital gains, & even tax-free bond interest can all increase the portion of your benefits that are taxed.

A. Earned Income (Wages or Self-Employment)

B. Passive Income (Rental or Business Income)

C. Capital Gains (Stocks, Real Estate, or Business Sales)

D. Tax-Exempt Interest

Example 1 — Lower-Income Single Retiree

Social Security: $20,000

Part-time income: $10,000

Provisional income = $10,000 + (½ × $20,000) = $20,000 → No Social Security tax.

Example 2 — Married Couple with Rentals

Social Security: $40,000

Rental income: $120,000

Provisional income = $120,000 + (½ × $40,000) = $140,000 → Up to 85% taxable.

Example 3 — Retiree with Capital Gains

Social Security: $30,000

Capital gain: $85,000

Provisional income = $85,000 + (½ × $30,000) = $100,000 → Up to 85% taxable this year.

Understanding the mechanics is the first step. The next is proactively managing your income sources:

Social Security taxation isn’t just about how much you receive — it’s about what else shows up on your tax return. By understanding how earned income, passive income, & capital gains interact, you can better control when & how much of your benefit is taxed.

At Abbey Street, we help clients navigate this complexity by building integrated tax, retirement, & investment strategies that maximize after-tax income in retirement.

For more guidance on how Social Security fits into your broader financial plan, contact the Abbey Street team.

Start a conversation to learn more about who we are and what we do. Our team is ready to make an impact.

Contact Us